Safelandings

Landing gear

Critical landing gear must perform without fault every time the aircraft flies. The nature and position of this critical component requires strength as well as wear and corrosion protection to fulfil design requirements. A combination of thermal processing techniques is used to ensure the materials' desired characteristics are achieved. Heat treatment is performed to change the properties of the materials allowing the parts to endure their harsh punishment. Environmentally friendly thermal spray processes such as HVOF have superseded traditional coating methods to aid corrosion and wear resistance properties.

Within the Aerospace, Defence & Energy (ADE) business, our customers think and operate globally and increasingly expect Bodycote to service them in the same way. Consequently, the ADE business is organised globally. This gives Bodycote a notable advantage as the only thermal processing company with a global footprint and knowledge of operating in all of the world's key manufacturing areas. A number of Bodycote's most important customers fall within the compass of ADE and Bodycote intends to continue to leverage its unique market position to increase revenues in these market sectors. The business incorporates the Group's activities in hot isostatic pressing and surface technology as well as the relevant heat treatment services, encompassing 64 facilities in total.

Results

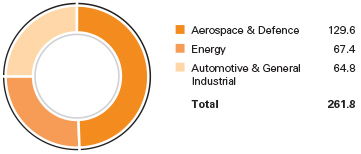

Revenues for the ADE business were £261.8m in 2013 compared to £258.0m in 2012, an increase of 1.5% (a 0.5% decline at constant exchange rates made up of 1.8% organic decline and 1.3% increase from acquisitions). Organic revenue reduction in the year reflects, on the one hand, a further increase in demand from aerospace and industrial gas turbine customers in all geographies and market share gains, particularly for subsea oil & gas requirements, but on the other very weak demand in North American onshore oil & gas.

Headline operating profit1 for ADE was £70.7m (2012: £69.1m). The headline operating profit margin improved from 26.8% to 27.0% as a result of a continuing improvement in mix of business.

In 2013, the Group added capacity in a number of aerospace-focused facilities, including the establishment of a new Surface Technology location in Houston, Texas. In the coming year it is expected that capital expenditure will again be slightly above depreciation as further capacity and capability are added to support continuing growth in aerospace demand.

Net capital expenditure in 2013 was £20.4m (2012: £21.0m) which represents 1.1 times depreciation (2012: 1.1 times).

Average capital employed in ADE in 2013 was £235.4m (2012: £227.9m). The small increase is primarily due to investment in new capacity to meet continued sales growth in the aerospace markets. Return on capital employed in 2013 was 26.1% (2012: 26.1%).

Achievements in 2013

The ADE divisions made further progress during the year in gaining new agreements with a range of customers and for a variety of end uses. In HIP, new customers, who are key suppliers to the oil majors in the subsea oil & gas market, have continued to be added as they adopt the Group's proprietary Product Fabrication (PF) offering.

Organisation and people

Total full-time equivalent headcount at 31 December 2013 was 1,945 (2012: 2,099), a decrease of 7.3% compared to revenue growth in ADE of 1.5%.

Looking ahead

Order books for commercial aerospace OEMs remain strong, although aircraft build rates in the higher volume platforms have now reached manufacturers' target levels. There is softness in North American onshore oil & gas demand but offtake appears to be improving slowly. Defence markets are expected to remain weak. Bodycote expects to be able to continue to capitalise on its world leading position and once again outperform the market.

- Headline operating profit is reconciled to operating profit in note 2 to the financial statements. Bodycote plants do not exclusively supply services to customers of a given market sector (see note 2 to the financial statements).

ADE revenue by geography

£m

ADE revenue by market sector

£m