Remuneration Policy

The objective of Bodycote's Executive Remuneration Policy is to provide remuneration that will reward and thereby retain talented people in the business and enable the recruitment of appropriately skilled and experienced newcomers. Therefore, the Executive Remuneration Policy is to set levels that attract and retain the talent responsible for executing strategy while ensuring the Company pays no more than is necessary.

Executive Remuneration Policy

The table below shows the Policy to be approved by shareholders on 29 April 2014, taking effect once approved by the AGM in 2014 and which we expect to apply for a period of three years.

Pay table

| Pay element and link to strategy | Maximum value | Operation |

|---|

Base salary

To ensure competitive salaries to attract and retain the talent required to execute the strategy while ensuring the Company pays no more than is necessary | Whilst the Committee has not set a maximum level of salary, ordinarily, salary increases will not exceed the average increase awarded to other Group employees. Increases may be above this level in certain exceptional circumstances, which may, for example, include: - Increase in scope or responsibility

- A new Executive Director is being moved to market positioning over time

| Base salaries for Executive Directors are typically reviewed annually (or more frequently if specific circumstances necessitate this) by the Committee in December each year. Salary levels are set and reviewed taking into account a number of factors including: - Role, experience and performance of the executive

- The Company's guidelines for salaries for all employees in the Group for the forthcoming year

- The competitiveness of total remuneration assessed against FTSE 250 companies and other companies of similar size and complexity, as appropriate

|

Pension

Provides a market-competitive benefit in order to attract the talent required to execute the strategy and provide a market-competitive level of provision for post-retirement income | Company contribution (or cash equivalent) of 30% of salary. | The Group operates a defined contribution scheme. The policy for Executive Directors is to make a contribution to this scheme or a cash allowance of equivalent value1. Base salary is the only pensionable element of remuneration. The same general approach applies to all employees, although contribution levels vary by seniority. |

Other benefits

Provides market-competitive benefits at an appropriate cost | The Committee has not set a maximum level of benefit, given that the cost of certain benefits will depend on the individual's particular circumstances. However benefits will be set at an appropriate level against market practice and needs for specific roles and individual circumstances. | The Company provides a range of cash benefits and benefits in kind to Executive Directors in line with market practice. These include the provision of company car (or allowance), private medical insurance, short- and long-term sick pay and death in service cover. This will also extend to the reimbursement of taxable work-related expenses, such as travel and relocation. The provision of other benefits payable to an Executive Director is reviewed by the Committee on an annual basis to ensure appropriateness in terms of the type and level of benefits provided. The Company provides a long-term savings vehicle into which the Executive Directors may elect to waive a proportion of pension allowance. In the case of non-UK Executives, the Committee may consider providing additional allowances in line with relevant market practice. |

Annual bonus

To incentivise delivery of corporate strategy and reward delivery of superior performance | The maximum potential is 130% of base salary for the CEO and 100% of base salary for other Executive Directors. | The level of bonus paid each year is determined by the Committee after the year end based on performance against targets. At least 70% of the bonus will be based on the achievement of Group financial targets. For 2014: - 70% of bonus is determined by Group headline operating profit against set targets

- 10% of bonus is determined by Group headline operating cash flow against set targets

- 20% of bonus is determined by the achievement of personal objectives, which may vary year-on-year to ensure that objectives are aligned with the business plan but our policy is to set goals which relate to the achievement of business strategy

The weighting of these measures and specific targets are reviewed on an annual basis to ensure alignment to strategy and are set to be in line with budget. Information on measures and weights that will apply for 2013 and 2014 are shown in the Board report on remuneration. The Committee considers the performance conditions selected for the annual bonus to appropriately support the Company's strategic objectives and provide a balance between generating profit and cash to enable the Group to pay a dividend, reward its employees and make future investments; and achieve other strategic goals to drive long-term sustainable return. At the threshold performance level there will normally be no more than 30% vesting. Awards commence vesting progressively from this point with maximum performance resulting in awards' vesting in full. Bonus payments are subject to the Committee's Malus Policy. |

Bodycote Incentive Plan ('BIP')

To incentivise delivery of long-term shareholder value

Aids retention of senior management | The maximum face value of an award which may be granted under the plan in any year is up to 175% of base salary for the Executive Directors. | The BIP is our primary long-term incentive plan. Conditional shares are awarded annually with vesting dependent on performance conditions measured over at least three years. Awards will be based on financial (and/or share price based) performance conditions as determined by the Committee. The performance conditions for awards granted in 2014 are as follows: - 50% of the award is subject to a return on capital employed ('ROCE') performance condition and 50% of the award is subject to an earnings per share ('EPS') performance condition.

- At the threshold performance level there will be zero vesting. Awards commence vesting progressively from zero on achievement of threshold performance with maximum performance resulting in awards vesting in full.

- In addition, for any award to vest (regardless of targets achieved) EPS must not be below a defined hurdle level.

|

| | The Committee reviews levels of awards and targets annually. In determining the performance targets applicable to awards, the Committee takes into account the current and forecast performance for the business and its sector, along with broker consensus to ensure stretch targets are set. Targets for each award are set out in Section B. Targets that apply to awards made in 2013 are shown in the Board report on remuneration. The Committee considers the performance conditions selected for the BIP to appropriately underpin the Company's strategic objectives. Due to the nature of the Company's activities the Committee consider ROCE to provide shareholders with an appropriate measure of how well the Company is performing and is being managed, while EPS provides a measure of the level of value created for shareholders. ROCE and EPS are our top two KPIs as shown in the Board report on remuneration of the Annual Report.

The Committee retains the discretion in exceptional circumstances to adjust the vesting outcome or the targets for awards as long as the adjusted targets are no less stretching. In such an event the Committee will consult with major shareholders and will clearly explain the rationale for the changes in the report on remuneration.

Dividend equivalents are payable in respect of the shares which vest. BIP awards are subject to the Committee's Malus Policy. |

Co-Investment Plan ('CIP')

To provide a link between short and long-term incentive arrangements and to provide further alignment with shareholders | Executive Directors can receive a maximum matching share award of up to 40% of base salary. | Executive Directors are invited annually to purchase shares up to 40% of basic salary (net of tax). The CIP provides for the grant of awards of performance based matching shares to participants on an annual basis in a maximum ratio of 1:1 to the gross investment made in deferred shares. The deferred shares must be held for at least three years. The matching shares will be based on share price related performance conditions as determined by the Committee. For 2014: The matching shares are subject to an absolute Total Shareholder Return ('TSR') performance measure which is expressed as percentage Compound Annual Growth Rate ('CAGR') in excess of CPI: - Threshold performance results in a 0.5:1 match

- Maximum performance results in a 1:1 match

The calibration of performance targets is reviewed by the Committee on an annual basis and is chosen in order to align with business strategy. Targets for the cycle vesting in respect of the year are disclosed in the Board report on remuneration. Dividend equivalents are payable in respect of the matching shares which vest. The Committee considers it appropriate to use an absolute TSR performance measure for awards made under the CIP so that participants are incentivised to and rewarded for providing absolute returns for shareholders. CIP awards are subject to the Committee's Malus Policy. |

Shareholding requirement

To provide alignment between Executive Directors and shareholders | Executive Directors are required to hold at least 100% of basic salary. | The Board operates a shareholding retention policy under which Executive Directors are expected, within five years from appointment, to build up a shareholding in the Company. The expectation is to hold at least 100% of basic salary. For the purposes of this requirement, only beneficially-owned shares will be counted. |

Malus

To provide the Committee flexibility to adjust remuneration levels in exceptional circumstances | Not applicable | The Malus Policy came into effect from 1 January 2013 and has been introduced to provide the Committee with discretionary powers to use malus performance based remuneration should exceptional circumstances occur. This Malus Policy is in respect of annual bonuses and long-term incentive awards. Exceptional circumstances necessitating malus would include: - Fraud;

- Misconduct;

- Significant misstatement of financial results; or

- Miscalculation of performance conditions.

Should the Committee, in its opinion, consider such circumstances to have occurred during a performance period from 2013 onwards then the Malus Policy will provide the Committee discretion to determine that any amounts paid or awards vested by reference to the relevant period, shall be subject to malus. Malus will start to apply to awards made from 2013. The Committee expects the mechanism to use malus for any such amounts will be to reduce future annual bonus payments, reduce the value of subsisting awards that have, at the relevant time, not yet vested or by reducing the level of award to be made at the following grant date. |

The Committee reserves the right to make any remuneration payments and payments for loss of office notwithstanding that they are not in line with the policy set out above where the terms of the payment were agreed (i) before the policy came into effect or (ii) at a time when the relevant individual was not a director of the Company and, in the opinion of the Committee, the payment was not in consideration for the individual becoming a director of the Company. For these purposes "payments" include the Committee satisfying awards of variable remuneration and, in relation to an award over shares, the terms of the payment being "agreed" at the time the award is granted.

Executive Directors' remuneration is reviewed annually and takes into account a number of factors. The Company adopts a policy of positioning fixed pay for all its employees at a level which is competitive to market but which does not require the Company to pay any more than is necessary. Senior and high performing individuals at all levels and across all functions within the organisation are invited to participate in both annual and long-term incentive arrangements, which are similar to those offered to the Executive Directors to ensure reward strategy is calibrated to provide substantive reward only on achievement of superior performance.

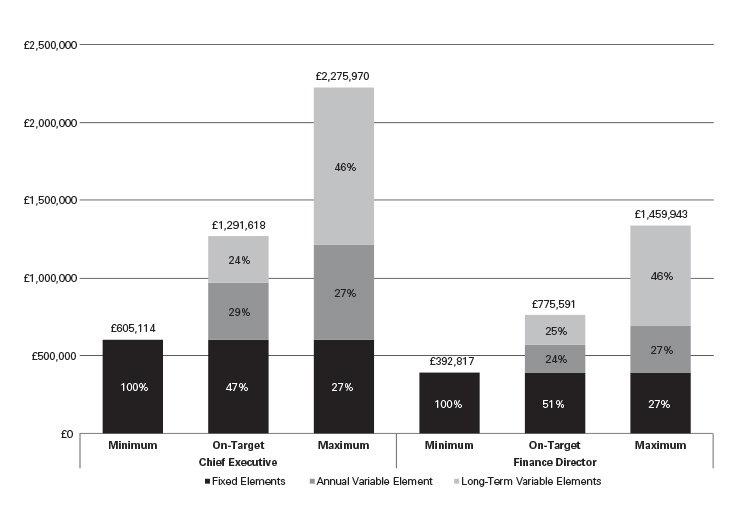

Illustrative remuneration outcomes at different performance levels

The chart below demonstrates the total amount of remuneration payable to the Executive Directors should they achieve below, at or above target performance.

For the purposes of this analysis, the following assumptions have been made:

- Fixed elements comprise base salary and other benefits:

- For the CEO: base salary of £484,306 and maximum potential benefits of £120,808

- For the Finance Director: base salary of £309,312, and maximum potential benefits of £83,505

- Base salary reflects the base salary as at 1 Jan 2014

- Benefits reflect benefits received in 2013

- For on-target performance, an assumption of 60% of annual bonus is applied and vesting of 25% for the BIP and 0.5:1 match for the CIP

- The value of the BIP and the CIP is based on the percentage of salary prior to the year of grant. The actual value on vesting will depend on the share price on the vesting date which is likely to be different from the date of grant

- The CIP assumes maximum contribution from the CEO and Finance Director

- No share price increase has been assumed

Recruitment policy

When recruiting new Executive Directors, the Company's policy is to pay what is necessary to attract individuals with the skills and experience appropriate to the role to be filled, taking into account remuneration across the Group, including other senior Executives, and that offered by other FTSE 250 companies and other companies of similar size and complexity. New Executive Directors will generally be appointed on remuneration packages with the same structure and pay elements as described in the pay policy table above. Each element of remuneration to be included in the package offered to a new director would be considered separately and collectively in this context.

On appointment to the Board or for a Non-Executive director taking an executive role:

- Base salary levels will be set in consideration of the new recruit's existing salary, location, skills and experience and expected contribution to the new role, the current salaries of other Executive Directors in the Company and current market levels for the role;

- Pension will be considered in light of the retirement arrangements which are in place for the other Executive Director(s) with a contribution level considered by the Committee to be appropriate in light of the new recruit's package as a whole, market practice at the time and on a broadly equivalent basis to existing provisions for other Executives;

- Other benefits will be considered in light of the provision in place for the other Executive Director(s). If it is in the best interests of the Company and shareholders, the Committee may consider providing additional benefits, potentially including relocation costs, tax equalisation or advisers' fees;

- The initial notice period may be longer than the Company's one year policy (up to a maximum of two years). However, this will reduce by one month for every month served, until the Company's policy position is reached;

- For annual bonus, the Company would consider whether it was appropriate for the new recruit to participate in the same annual incentive plan applicable to the current Executive Directors. If this was considered appropriate, the same financial measures, weighting, payout scale and target as well as maximum bonus opportunity (as a percentage of salary) which apply to the existing director(s) would generally apply to the new recruit;

- The Committee will determine when long-term incentive awards will be granted during the year; and

- The Company is required to set out the maximum amount of variable pay which could be paid to a new director in respect of his/her recruitment. In order to provide the Company with sufficient flexibility in a recruitment scenario, the Committee has set this figure as 450% of base salary. This covers the maximum annual bonus and the maximum face value of any long-term incentive awards. This level of variable pay would only be available in exceptional circumstances, and in order to achieve such a level of variable pay, stretching targets would need to be met. For the avoidance of doubt, this 450% variable pay limit excludes the value of any "buyout" payments or awards associated with forfeited awards.

For an external appointment, although there are no plans to offer additional cash and/or share-based payments on recruitment, the Committee reserves the right to do so when it considers this to be in the best interests of the Company and shareholders. Such payments may take into account remuneration relinquished when leaving the former employer and would reflect the nature, time horizons and performance requirements attached to that remuneration. Shareholders will be informed of any such payments at the time of appointment. The Committee may make awards on hiring an external candidate to "buyout" awards which will be forfeited on leaving the previous employer. Our approach to this is to carry out a detailed review of the awards which the individual will lose and calculate the estimated value of them. In doing so, we will consider the vesting period, the option exercise period if applicable, whether the awards are cash or share based, performance related or not, the Company's recent performance and payout levels and any other factors we consider appropriate. If a buyout award is to be made, the structure and level will be carefully designed and will generally reflect and replicate the previous awards as accurately as possible. We will make the award subject to appropriate malus provisions in the event that the individual resigns or is summarily terminated within a certain timeframe. An explanation will be provided at the time of recruitment of why a buyout award has been granted.

Shareholders will be informed of any Director appointment and the individual's remuneration arrangements as soon as practicable following the appointment via an announcement to the regulatory news services.

Fee levels for a new Chairman or new Non-Executive Directors will be determined in accordance with the policy set out above.

Termination remuneration policy

It is the Company's policy that Executive Directors have service contracts with a one-year notice period and terminable by one year's notice by the employer at any time, and by payment of one year's basic salary and other fixed benefits in lieu of notice by the employer. All future appointments to the Board will comply with this requirement.

Currently, under the terms of the Executive Directors' contracts, the Company may at its choice, in lieu of giving notice, terminate an Executive Director's service contract by making a payment equivalent to:

- One year's annual base salary, 25% of base salary in respect of all other remuneration and benefits (other than annual bonus and incentives) and annual bonus equal to the average bonus paid up to three years prior to the date of notice.

Our policy is not to have a change in control clause in Executive Directors' service contracts. Stephen Harris does not have a change of control clause. David Landless' service contract was agreed in accordance with what was considered best practice at the time of its execution in 2001 and provides for one year's remuneration if his employment is terminated on a change of control. This provision has been preserved. To the extent that executive contracts are renewed, or new appointments made, the Committee will continue to adopt a policy of not having change of control clauses in service contracts. In any case, legally appropriate factors would be taken into account to mitigate any compensation payment, covering basic salary, annual incentives and benefits, which may arise on the termination of employment of any Executive Director, other than payments made on a change in control or for payments in lieu of notice.

In the event that an Executive Director leaves the Company, the Committee's policy for exit payments is to consider the reasons for cessation and consequently whether any exit payments other than those contractually required are warranted.

On cessation of employment, awards under the BIP and CIP will lapse in full, unless the Committee in its absolute discretion determines otherwise. In instances where the Committee determines that awards should not lapse in full, the Committee will consider the performance conditions applying to any unvested awards and the performance period which has elapsed. Awards will usually be subject to some form of time pro-rating reduction to reflect the unexpired portion of the performance or deferral period concerned. Awards that are subject to performance conditions will usually only vest to the extent that these conditions are satisfied. Awards which do not lapse on cessation of employment may either vest at that time or on their originally anticipated vesting date.

On termination, the accumulated funds invested in the Bodycote Investment Incentive Plan (further information on this long-term savings vehicle is available in the Board report on remuneration) will normally be released to the participant subject to Committee discretion.

On change of control the awards will generally vest subject to performance and time apportionment as determined by the Committee and in accordance with the rules of the relevant plan.

Service contracts

All Directors' service contracts are available for inspection at the Company's registered office.

A summary of the key terms of the Executive Directors Service Contracts is set out below:

| S.C. Harris | D.F. Landless |

|---|

| Date of service contract | 6 October 2008 | 26 September 2001 |

| Notice period | 12 months | 12 months |

| Remuneration | - Annual base salary

- Potential for cash in lieu of pension

- Reimbursement of expenses (if satisfactory evidence provided)

- Private medical insurance

- Company car allowance

- Entitlement to receive an annual performance related bonus award

| - Annual base salary

- Potential for cash in lieu of pension

- Reimbursement of expenses (if satisfactory evidence provided)

- Private medical insurance

- Company car allowance

- Entitlement to receive an annual performance related bonus award

- Entitlement to one year's remuneration if employment is terminated on a change of control

|

| Termination | Company has right to terminate on payment of a termination payment with agreement of executive | Company has right to terminate on payment of a termination payment |

| Non-Competition | During employment and for 12 months thereafter | During employment and for 12 months thereafter |

Other than the contents of the contracts, there are no other obligations that may give rise to remuneration.

Chairman and Non-Executive Directors Policy

The Chairman and each Non-Executive Director hold letters of appointment which have been agreed which set out the terms of their appointment, including membership of the Board Committees, the fees to be paid and the time commitment expected from the Director.

It is the Board's policy that the Chairman and Non-Executive fees are reviewed on an annual basis. The fees for the Chairman are reviewed by the Board in the absence of the Chairman. The fees for the Non-Executive Directors are reviewed by the Chairman and Executive Directors. When reviewing fees, the primary source for comparative market data is FTSE 250 companies and other companies of similar size and complexity, as appropriate.

Fees for the Chairman and Non-Executives are set at a level that will attract individuals with the necessary experience and ability to make a significant contribution to the Group's affairs. The Committee seeks to recruit Non-Executive Directors with the experience to contribute to the Board with a balance of personal skills that will make a major contribution to the Board and it's committee structures.

The Company's policy is that the Chairman and Non-Executive Directors receive a fixed fee for their services as members of the Board and its Committees. The fee structure may also include additional fees for chairing a Board Committee and/or for further responsibilities (for example, Senior Independent Directorship). Fee levels take into account the level of time commitment and duties and responsibilities involved. The Chairman and Non-Executive Directors are not entitled to any pension or other employment benefits or to participate in any incentive scheme. In line with the Articles of Association, accumulative Non-Executive Director fees are capped at £500,000 p.a.

| Director | Date of appointment | Notice period |

|---|

| A.M. Thomson | 1 December 2007 | 6 months |

| J.A. Biles | 16 August 2007 | 6 months |

| K. Rajagopal | 24 September 2008 | 6 months |

| E. Lindqvist | 1 June 2012 | 6 months |

Fees retained for external Non-Executive Directorships

To broaden the experience of Executive Directors, they may hold positions in other companies as Non-Executive Directors provided that permission is sought in advance. Any external appointment must not conflict with the Directors' duties and commitments to Bodycote plc. Stephen Harris has held such a position at Mondi plc since 1 March 2011 and in accordance with Group policy he retained fees for the year of £82,919.45. David Landless was appointed a Non-Executive Director of Luxfer Holdings plc with effect from 1 March 2013 and retained fees for the year of £40,238. In addition, David Landless was given 1,924 of Luxfer American Depositary Receipts valued at $30,000 at the date of grant on 1 March 2013.

Statement of consideration of employment conditions elsewhere in the Company

The Company adopts a policy of positioning fixed pay for all its employees at a level which is competitive to market but which does not require the Company to pay any more than is necessary. Senior and high performing individuals at all levels and across all functions within the organisation are invited to participate in both annual and long-term incentive arrangements, similar to the Executive Directors to ensure reward strategy is calibrated to provide substantive reward only on achievement of superior performance.

The Committee does not consult directly with employees when formulating Executive Director pay policy. However, it does take into account information provided by the Human Resources function and feedback from employee satisfaction surveys.

In formulating Executive Director pay policy, the Committee receives information on all employee pay conditions throughout the Group.

Statement of consideration of shareholder views

The Committee always welcomes the views of shareholders in respect of pay policy as well as those views expressed on behalf of shareholders by their respective proxy advisers. The Committee documents all remuneration related comments made at the Company's AGM and feedback received during consultation with shareholders throughout the year. Any feedback received is fully considered by the Committee and, where appropriate, amendments are made to remuneration policy.

During 2013, the Committee decided that participants receiving awards under the CIP and BIP will be eligible to receive dividend equivalents on un-vested shares payable at the time of vesting. The Committee consulted with key shareholders on this point and they were supportive of the change.